Invest in Scaling Climate Solutions

Climate Opportunity

Climate Investing Platforms

Climate Investing Resources

ESG 529 Plans

Fossil Free Funds

My Climate Journey Startup Series

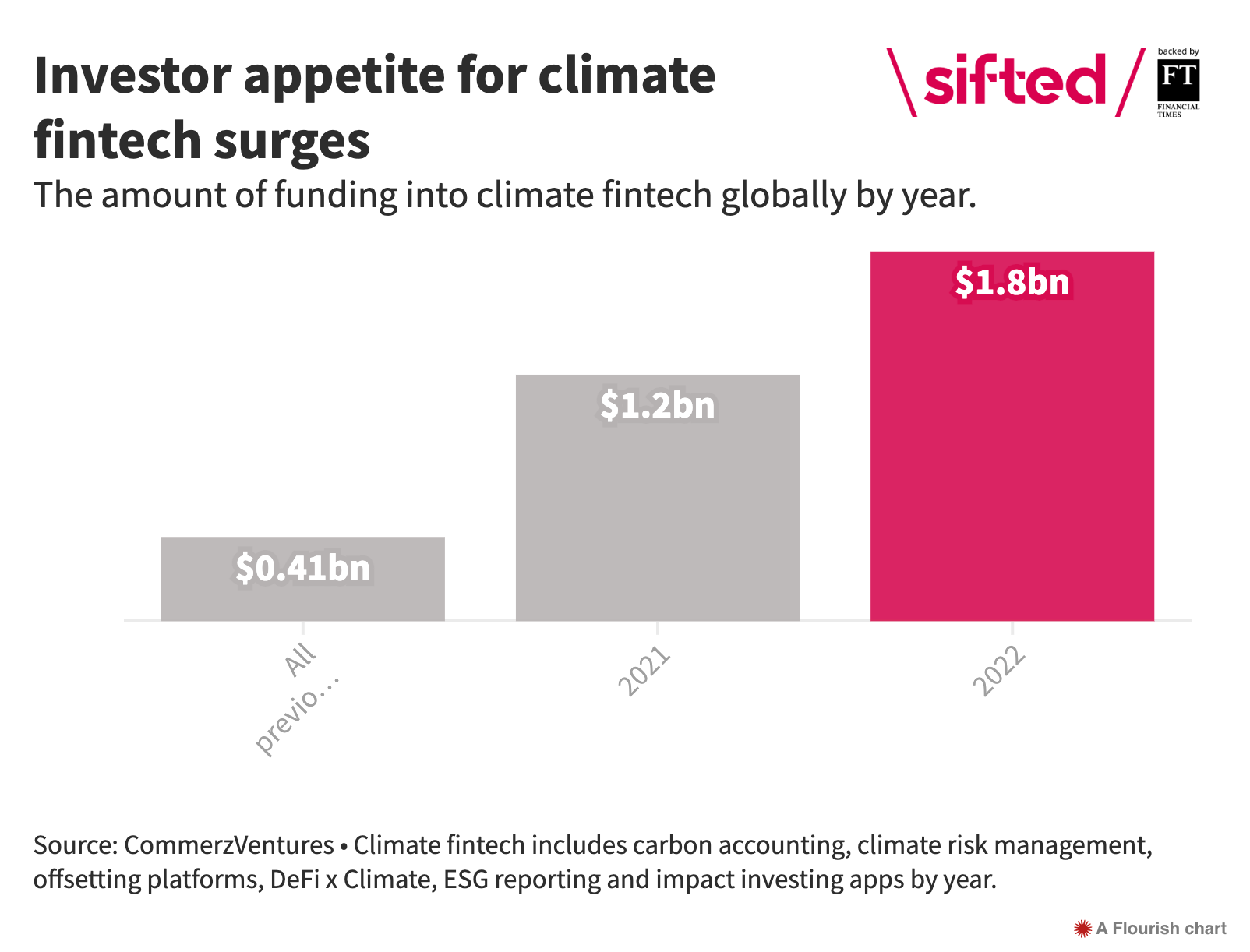

Companies that can solve the climate crisis profitably will enable us to solve it faster. Smart money invested in climate solutions stands to grow for decades to come

Read more about Climate Opportunity on the Climate Economy blog:

Climate Opportunity Examples

Agriculture

Regenerative agriculture, curbing food waste, sequestering carbon in soils is just the beginning

Jobs

Safer, healthier, more equitable job creation is possible throughout the climate economy

Health

Slowing the climate crisis can mean reducing health impacts from pollution, adverse weather, and infectious disease

Infrastructure

Novel ways of delivering essential services in with climate positive technologies will be a growth industry for decades to come

Transportation

Safer and more efficient ways to get around

WE are the Markets.

Working all together, people can unlock the capital

needed to solve the #climatecrisis faster

Want More Info?

We'd love to keep you posted on what we are up to.

![Wintry off white background "[Fossil] Free Your Funds" Also: "[FUND] #GiftsToTheFuture enough.co/gifts-to-the-future 23"](https://enough.co/wp-content/uploads/2022/12/23-FB-GiftsToTheFuture.png)