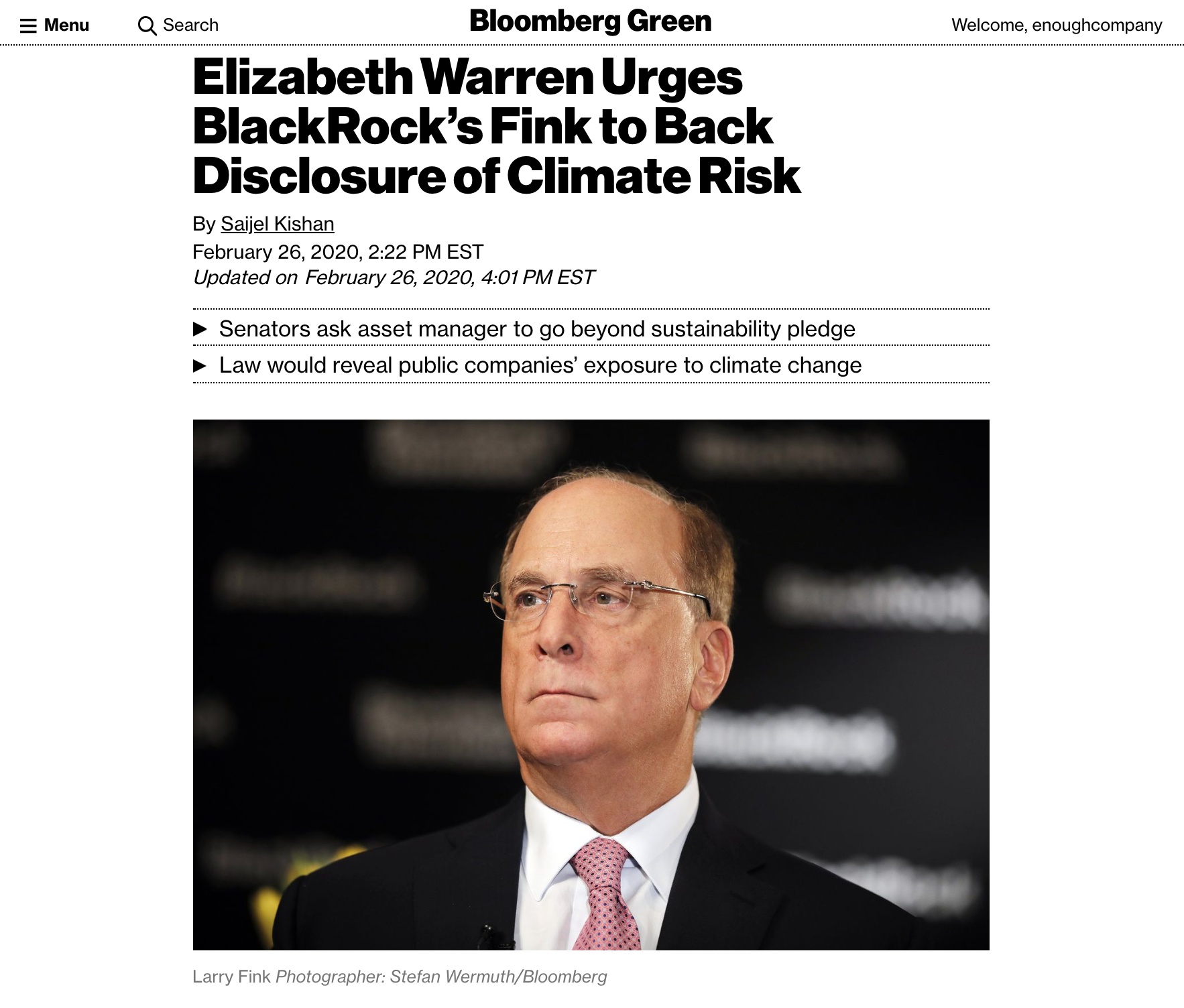

To understand shifts in the climate economy, You Need to Read up on BlackRock CEO Larry Fink. I have a podcast and a quick article to help: New York Times’ The Daily podcast Can Corporations Stop Climate Change? by Michael Barbaro and Andrew Ross Sorkin (transcript here), and Bloomberg Green’s Elizabeth Warren Urges BlackRock’s Fink to Back Disclosure of Climate Risk by Saijel Kishan.

The Daily’s episode with Sorkin brilliantly recaps the outsized impacts of Larry Fink’s annual letter to CEOs in 2016 and 2018, and then underscores why Larry Fink’s opinion matters:

It has weight. Because he genuinely is the largest investor in the world… He can vote that board out if he doesn’t like what they’re doing. In certain cases, he can pull his money from their companies if he doesn’t like what they’re doing.

Of the 2020 letter’s stance on climate, Sorkin explains:

He’s saying for the very first time, as the largest investor in the world, that climate change has to become an integral part of the investing thesis for companies. And more importantly, that C.E.O.s and companies themselves now have to change and think about climate change. And if they don’t, he’s going to be pulling his money from them.

…this is not driven by ideology. It’s not driven by politics. It’s driven frankly by money. He thinks that there’s now a genuine business risk and cost to not doing anything.

He goes on to concisely lay out the immediate chorus of reactions to this letter, from Microsoft to Delta to Jeff Bezos’ $10 billion pledge, and which are substance vs hype.

And literally within the next 21 days company after company starts announcing new initiatives around climate.

So it’s no surprise that in an open letter, four US Senators are now asking BlackRock CEO Larry Fink to back policy requiring companies to measure and disclose climate risk:

– Senators ask asset manager to go beyond sustainability pledge

– Law would reveal public companies’ exposure to climate change

Like similar letters sent to the 8 major US banks in January, the Senators’ letter presses for BlackRock to comment on risk and on what concrete steps they have taken since making their public commitments.

Bring your loved ones together this holiday season to give #GiftsToTheFuture. Each day on the way to welcoming the new year, we'll share a little something you can do to help make it (and many years that follow) better for those you love. enough.co/gifts-to-the-future

How you earn, spend, save, and invest can grow climate solutions faster. Let's work on it together?

Where You Bank is What You Build II

It's been more than 3 years since we published Where You Bank is What You Build, and there are a lot more great options for decarbonizing...

Day 23 | [Fossil] Free Your Funds

Gifts to the Future "Your retirement plan may be fueling the climate crisis. But it doesn't have to." - As You Sow If you're lucky enough...

Gifts to the Future

#GiftsToTheFuture: Bring your loved ones together this holiday season to give #GiftsToTheFuture. Each day on the way to welcoming the new...

Laura Fitton, Founder

Principal and Speaker

I founded enough.co to explain and evangelize market-driven shifts that can bring speed and scale to the climate fight.

My approach merges my environmental science and policy degree with my expertise as a tech CEO/Founder, growth executive, author, speaker, and recognized trailblazer.

My research on environment and justice is published in Science and by the Center for Policy Alternatives, and I've spoken at Harvard Business School, MIT Sloan, and a great many conferences.

![Day 23 | [Fossil] Free Your Funds](https://enough.co/wp-content/uploads/2022/12/23-FB-GiftsToTheFuture-400x250.png)