Citing the Federal Reserve, on January 22 Senator Elizabeth Warren asked eight major U.S. banks to answer questions about climate adaptation and mitigation risks to their solvency and the broader economy. We asked the banks: will you answer her?

In the her letters, Warren asked:

“I write to ask for more information about the risks caused by the climate crisis on the financial industry and your institution’s practices, including what steps, if any, your institution is taking to mitigate these risks.”

Per Warren’s press release, the Senator also asked:

“As climate change continues to affect our economy, it is critical to understand your bank’s adaptation and mitigation strategies. While some central banks around the world are taking action to confront climate-related risks to the global financial system, U.S. regulators continue to ignore the risks, despite the San Francisco Fed’s groundbreaking work. To protect themselves and the economy from climate-driven catastrophes, large financial institutions must act quickly to address risks.”

The letters, sent to the eight global systemically important banks (G-SIBs) under U.S. jurisdiction, set a February 7 deadline for a detailed written response.

“To protect themselves and the economy from climate-driven catastrophes, large financial institutions must act quickly to address risks.”

Warren asked questions regarding the severity of climate risks to the U.S. economy and financial system based on research by the Federal Reserve Bank of San Francisco, recent statements from Federal Reserve Board Governor Lael Brainard, and similar planning done by dozens of central banks.

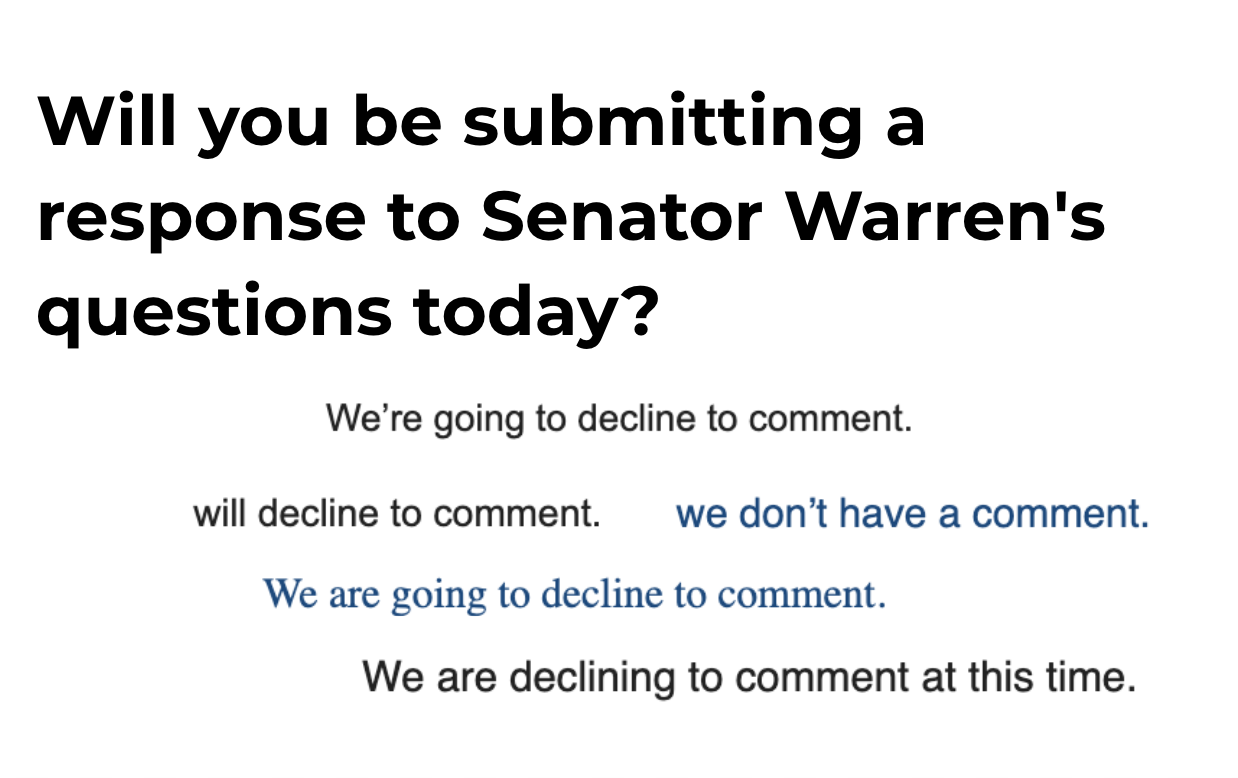

Since today’s the deadline for written responses, I contacted each bank with three simple questions:

- Will you be submitting a response to Senator Warren’s questions today?

- If so, is there a public link or comment we can share?

- If not today, when?

Only Goldman Sachs confirmed that the bank is responding directly to Senator Warren.

JP Morgan’s media spokesperson has not yet shared their official comment. BNY Mellon, Citigroup, Morgan Stanley, State Street, and Wells Fargo each declined to comment on whether or not they were going to answer the Senator, and Bank of America did not respond before this story was published.

What will it take for these so-called “too big to fail” banks to even answer questions about whether or not they are taking steps to address their direct financial climate risk?

Read more on the Climate Economy blog…

Where You Bank is What You Build II

It's been more than 3 years since we published Where You Bank is What You Build, and there are a lot more great options for decarbonizing your money. Here are a few: Bank for Good Ask Sustainable...

Day 23 | [Fossil] Free Your Funds

Gifts to the Future "Your retirement plan may be fueling the climate crisis. But it doesn't have to." - As You Sow If you're lucky enough to have a 401(k), IRA, 529 or other investments, you...

YNTR: What Could Warming Mean for Pathogens Like Coronavirus?

While the current global COVID19 pandemic has not been linked to climate change, climate is expected to directly the spread of pathogens and disease. Exact impacts are hard to predict, but seasonality (flu), wildlife habits (for vector-borne diseases like malaria), and unstudied effects on human-to-human contagions are all possible results.

Laura Fitton, Founder

Principal and Speaker

I founded enough.co to explain and evangelize market-driven shifts that can bring speed and scale to the climate fight.

My approach merges my environmental science and policy degree with my expertise as a tech CEO/Founder, growth executive, author, speaker, and recognized trailblazer.

My research on environment and justice is published in Science and by the Center for Policy Alternatives, and I've spoken at Harvard Business School, MIT Sloan, and a great many conferences.