You Need to Read BlackRock Chairman/CEO Larry Fink’s 2020 Letter to CEOs.

Based on several years of BlackRock Institute research evaluating the economic risks of the climate crisis, this institution is taking a definitive stance on the potential impact of unpriced climate risks in equity markets, calling it “a fundamental reshaping of finance” and stating that “the evidence on climate risk is compelling investors to reassess core assumptions about modern finance.”

As an asset manager, BlackRock invests on behalf of others, and I am writing to you as an advisor and fiduciary to these clients. The money we manage is not our own. It belongs to people in dozens of countries trying to finance long-term goals like retirement. And we have a deep responsibility to these institutions and individuals – who are shareholders in your company and thousands of others – to promote long-term value.

Climate change has become a defining factor in companies’ long-term prospects. Last September, when millions of people took to the streets to demand action on climate change, many of them emphasized the significant and lasting impact that it will have on economic growth and prosperity – a risk that markets to date have been slower to reflect. But awareness is rapidly changing, and I believe we are on the edge of a fundamental reshaping of finance.

Bring your loved ones together this holiday season to give #GiftsToTheFuture. Each day on the way to welcoming the new year, we'll share a little something you can do to help make it (and many years that follow) better for those you love. enough.co/gifts-to-the-future

How you earn, spend, save, and invest can grow climate solutions faster. Let's work on it together?

Day 23 | [Fossil] Free Your Funds

Gifts to the Future "Your retirement plan may be fueling the climate crisis. But it doesn't have to." - As You Sow If you're lucky enough...

Gifts to the Future

#GiftsToTheFuture: Bring your loved ones together this holiday season to give #GiftsToTheFuture. Each day on the way to welcoming the new...

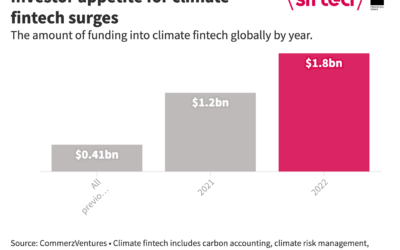

$3 Billion VC Goes into Climate Fintech in the Last 18 Months

Eye-popping graph from sifted.eu... All VC investment in climate fintech through the end of 2020 totalled $.41 billion. From 1/21-6/22 VCs...

Laura Fitton, Founder

Principal and Speaker

I founded enough.co to explain and evangelize market-driven shifts that can bring speed and scale to the climate fight.

My approach merges my environmental science and policy degree with my expertise as a tech CEO/Founder, growth executive, author, speaker, and recognized trailblazer.

My research on environment and justice is published in Science and by the Center for Policy Alternatives, and I've spoken at Harvard Business School, MIT Sloan, and a great many conferences.

![Day 23 | [Fossil] Free Your Funds](https://enough.co/wp-content/uploads/2022/12/23-FB-GiftsToTheFuture-400x250.png)