You Need to Read The Financial Times’ Lex in Depth: The $900bn Cost of ‘Stranded Energy Assets’ by Alan Livsey

Fossil fuel divestment is no longer a “should do” motivated by pro-climate activism, it’s a “must do” for fiduciary reasons. Market and policy forces are already undercutting hydrocarbon economics and nearly $900 billion (about a third of the value of big oil and gas companies) is at risk of becoming worthless due to climate change.

Climate targets may force energy groups to leave huge reserves of coal, oil and gas in the ground

…But just as easily he could have been targeting global investors whose trenchant criticism of hydrocarbons has led to a shift in investment away from the traditional energy sector and into renewables.

This move represents a big problem for energy groups such as Exxon, BP and Saudi Aramco.

Vast swaths of their oil, gas and coal reserves may never be extracted and burnt because doing so would intensify global warming, worsening freak weather events and threatening the loss of farmland and huge population displacement. That could leave them with large numbers of what are known as “stranded assets”

At targets to achieve just 1.5C in heating 16% of carbon in the ground can be brought to market, leaving “over 80 per cent of carbon in the ground .. stranded and theoretically worthless.” These stranded assets…

those investments which have already been made but which, at some time prior to the end of their economic life, are no longer able to earn an economic return

…are the root of the financial risk burden these companies carry. Risks include:

- Stranded Assets – assets currently contributing to the market value of the company that cannot actually be developed and sold

- Loss of market capitalization – downward pressure on the stock price from institutional investors divesting can hurt your mutual funds and stocks

- Cost of capital – already fewer banks are willing to finance these projects, so it’s progressively more expensive to bring the assets to market

- Scarcity of insurance – similarly, fewer insurance companies are willing to back projects, which increases both the cost and time required to get insurance to build them

- Insufficient renewables investment – faced with this disruption it would be smart to develop substantial lines of business without these risks, but current investment in low carbon energy sources is less than 1%

- Market risk – how stock markets choose to value reserves is also subject to change

We’re at a tipping point where divestment itself is becoming more about avoiding financial risk than it is about climate resistance and activism. The fundamental value of these companies is already $400bn lower than it was 5 years ago, is facing serious future risk, and there are follow-on risks to the rest of any economy that remains dependent on oil and gas.

Markets will price in the risk of asset writedowns by the world’s oil and gas companies. That may happen gradually, but unless a solution is found for climate change in the coming decade, there is a risk of a sharp collapse in asset prices of IOCs, one that goes beyond the scenarios here.

The greatest threat is faced by economies that have become dependent on oil and gas. However, the effects of writing off stranded assets would be felt across the business world. It would be one of the biggest ever shifts in the allocation of capital.

Regardless of anyone’s stance on climate, understanding climate risks, and moving investments, business activities, buying habits, and other financial interests away from it is no longer just an “activist” stance.

Bring your loved ones together this holiday season to give #GiftsToTheFuture. Each day on the way to welcoming the new year, we'll share a little something you can do to help make it (and many years that follow) better for those you love. enough.co/gifts-to-the-future

How you earn, spend, save, and invest can grow climate solutions faster. Let's work on it together?

Day 23 | [Fossil] Free Your Funds

Gifts to the Future "Your retirement plan may be fueling the climate crisis. But it doesn't have to." - As You Sow If you're lucky enough...

Gifts to the Future

#GiftsToTheFuture: Bring your loved ones together this holiday season to give #GiftsToTheFuture. Each day on the way to welcoming the new...

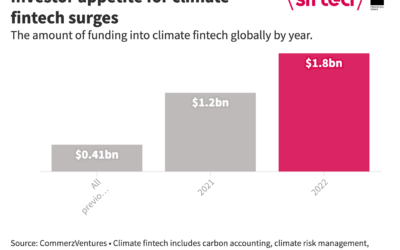

$3 Billion VC Goes into Climate Fintech in the Last 18 Months

Eye-popping graph from sifted.eu... All VC investment in climate fintech through the end of 2020 totalled $.41 billion. From 1/21-6/22 VCs...

Laura Fitton, Founder

Principal and Speaker

I founded enough.co to explain and evangelize market-driven shifts that can bring speed and scale to the climate fight.

My approach merges my environmental science and policy degree with my expertise as a tech CEO/Founder, growth executive, author, speaker, and recognized trailblazer.

My research on environment and justice is published in Science and by the Center for Policy Alternatives, and I've spoken at Harvard Business School, MIT Sloan, and a great many conferences.

![Day 23 | [Fossil] Free Your Funds](https://enough.co/wp-content/uploads/2022/12/23-FB-GiftsToTheFuture-400x250.png)