You Need to Read The Intelligencer’s The Fossil-Fuel Companies Expect to Profit from Climate Change by Malcolm Harris

Kids These Days author Malcolm Harris attended an October, 2019 workshop with Royal Dutch Shell’s Shell Scenarios team. His in-depth essay explores the strategic and economic calculations factoring into Shell’s oil and gas and renewable alternatives development decisions and future planning.

In December, a couple of months after the Shell workshop, the Bank of England proposed a new climate stress test to measure the resiliency of its banks in the face of warming — a move echoing that of Christine Lagarde of the European Central Bank and reportedly being considered by the chair of the U.S. Federal Reserve, Jerome Powell. Germany announced major coal phaseouts in January with coal-fired power generation scheduled to halt by 2038 at the latest. In a much-celebrated letter the same month, Larry Fink, the CEO of BlackRock, the world’s largest asset manager, declared an about-face on fossil fuels, saying climate change was now a “defining factor in companies’ long-term prospects.” The entire country of Finland proclaimed it would go carbon neutral by 2035. Even the investor cartoon Jim Cramer, of Mad Money, got in on divestment, tweeting, “I am taking a hard pass on anything fossil.” Now ExxonMobil is down $184 billion-with-a-b since its 2014 peak..

It’s not necessarily such a bad time to be an oil and gas company, in other words, but it is a bad time to look like one. These companies aren’t planning for a future without oil and gas, at least not anytime soon, but they want the public to think of them as part of a climate solution. In reality, they’re a problem trying to avoid being solved.

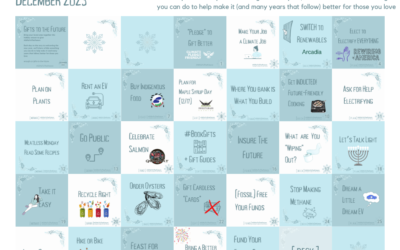

Bring your loved ones together this holiday season to give #GiftsToTheFuture. Each day on the way to welcoming the new year, we'll share a little something you can do to help make it (and many years that follow) better for those you love. enough.co/gifts-to-the-future

How you earn, spend, save, and invest can grow climate solutions faster. Let's work on it together?

Where You Bank is What You Build II

It's been more than 3 years since we published Where You Bank is What You Build, and there are a lot more great options for decarbonizing...

Day 23 | [Fossil] Free Your Funds

Gifts to the Future "Your retirement plan may be fueling the climate crisis. But it doesn't have to." - As You Sow If you're lucky enough...

Gifts to the Future

#GiftsToTheFuture: Bring your loved ones together this holiday season to give #GiftsToTheFuture. Each day on the way to welcoming the new...

Laura Fitton, Founder

Principal and Speaker

I founded enough.co to explain and evangelize market-driven shifts that can bring speed and scale to the climate fight.

My approach merges my environmental science and policy degree with my expertise as a tech CEO/Founder, growth executive, author, speaker, and recognized trailblazer.

My research on environment and justice is published in Science and by the Center for Policy Alternatives, and I've spoken at Harvard Business School, MIT Sloan, and a great many conferences.

![Day 23 | [Fossil] Free Your Funds](https://enough.co/wp-content/uploads/2022/12/23-FB-GiftsToTheFuture-400x250.png)