The climate crisis will impact every economic sector

Climate Risk

Climate related financial risks

are still largely unmeasured, undisclosed, & unpriced

At their healthiest, prices in any market prices reflect many parties’ assessments of future risks and future opportunities. This is why measurement, disclosure, and mitigation of risk is such a huge part of any financial operation.

The climate crisis has already cost billions of dollars in direct and indirect economic damages from air pollution, droughts, fires, floods, hurricanes, and sea level rise spanning across multiple industries. It’s time to understand and plan for how climate risk may impact you, your income, investments, job, company, industry, and the economy in general.

Eventually the economic impacts of the climate crisis will touch every sector of the economy. On this page, we will track resources, news, and research on climate risk, starting with the most clearly impacted sectors and adding new ones as data become available.

Clear, present, and underpriced: the physical risks of climate change – Rhodium Group report, April 2019

Read more about Climate Risk on the Climate Economy blog:

Most-Impacted Sectors

Agriculture

Banking

Coal

Financial System

Infrastructure

Insurance

Oil & Gas

Public Equity

Private Equity

Real Estate

Transportation

Resources

Climate Risks by Economic Sector

Agriculture

Soil depletion, changing demand, supply chain, direct impacts on climate, desertification, weather patterns, wildfires, unpredictable growing seasons

Banking

Asset damage, loan defaults, insurance losses, tax losses to municipalities

Bank regulators present dire warning of financial risks from climate change

Coal

Finance risk, insurance risk, decreased demand, large-scale divestment, competitive risk from renewables, policy risk

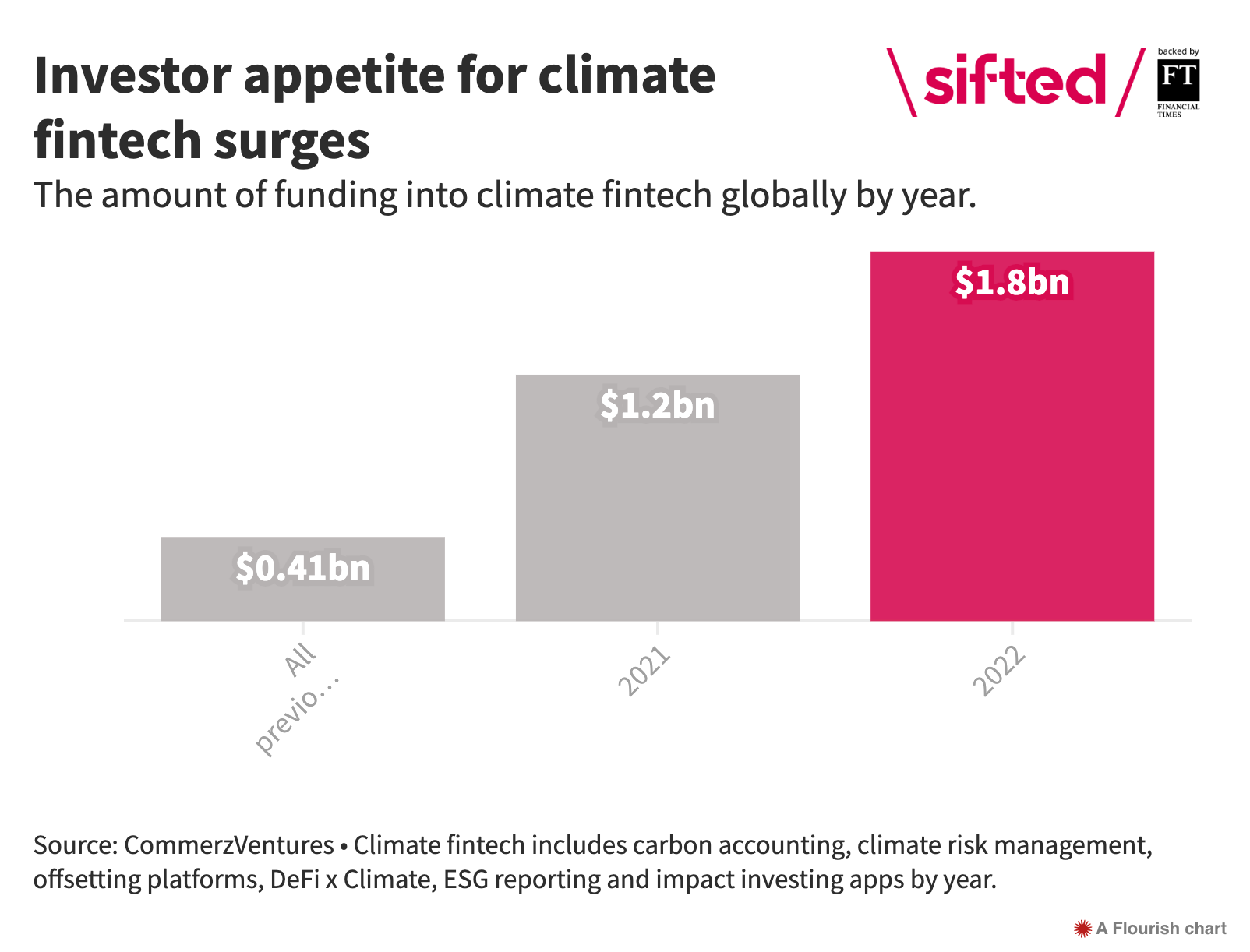

Financial System

Insurance/reinsurance market failures, undisclosed climate risks, policy shock Climate change threatens the stability of the financial system

Infrastructure

Damage from severe weather and fire events, inability to rebuild in impacted areas, effects on bond markets

Muni bonds face climate change and investors are ignoring the risks

Insurance

Losses sustained during severe weather and fire events, failure of reinsurance markets

How insurance companies can prepare for risk from climate change

Oil & Gas

Decreased demand, large-scale divestment, liability, project finance and insurance risks, policy risk

YNTR: Lex in Depth: the $900bn cost of stranded energy assets

Public Equity

Disclosure of climate related risks, large scale divestment, falling demand for climate polluting goods and services, loss of market cap leading to losses for endowments, pensions, and other large funds

Private Equity

Project finance, insurance, falling demand for climate polluting goods and services, loss of market cap leading to losses for endowments, pensions, and other large funds

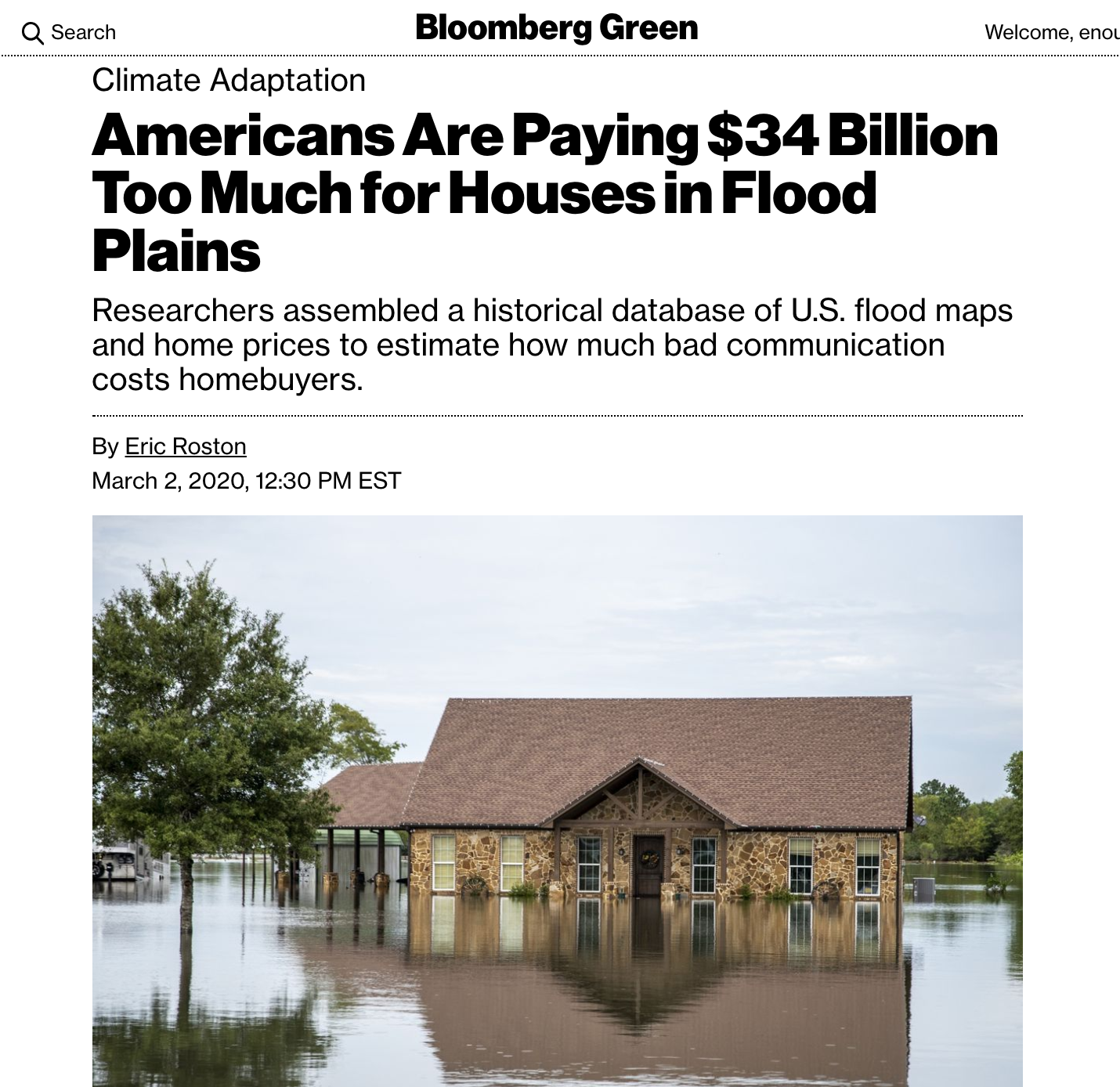

Real Estate

Severe weather damage and impact on demand, cost of retrofitting, ability to get insurance and financing

Transportation

Infrastructure damage, changes to supply chains, reduced demand, lack of market for fossil fuel powered vehicles, policy risks

Why the transport sector needs to adapt to climate change

WE are the Markets.

Working all together, people can unlock the capital

needed to solve the #climatecrisis faster

Want More Info?

We'd love to keep you posted on what we are up to.